The rise of cryptocurrency has significantly reshaped the way we think about money, payments, and security. However, to fully participate in this new digital economy, users must manage their digital assets efficiently and securely. This is where crypto wallet apps come into play. A crypto wallet app is a software application that allows users to store, manage, and transact with their cryptocurrencies. These wallets offer a secure environment to store private keys, the unique passwords required to access and control cryptocurrencies.

In this article, we will explore what crypto wallet apps are, how they work, their types, key features, security considerations, and much more. We will also dive into common FAQs and provide key takeaways to help you understand how to choose the right wallet for your needs.

Key Takeaways

| Aspect | Details |

|---|---|

| Types of Wallets | Hot Wallets (internet-connected) and Cold Wallets (offline) |

| Security Features | 2FA, Encryption, Backup & Recovery Options |

| Supported Cryptocurrencies | Choose a wallet that supports the cryptocurrencies you use |

| Transaction Fees | Fees vary; higher fees may lead to faster transactions |

| Ease of Use | Simple UI for beginners, but advanced features for experts |

| Cross-Platform | Ensure wallet is available on mobile, desktop, and web platforms |

| DeFi Compatibility | Some wallets integrate with DeFi apps for advanced users |

What is a Crypto Wallet App?

A crypto wallet app is a mobile or desktop application that allows users to store and manage their cryptocurrency holdings. Unlike traditional wallets that store physical money, crypto wallets store private keys – essentially a digital signature that proves ownership of a cryptocurrency. The app can be used for a variety of tasks, including:

- Sending and receiving cryptocurrencies

- Checking balance and transaction history

- Converting between different cryptocurrencies

- Interacting with decentralized applications (dApps) in some cases

- Storing private keys securely

Most crypto wallet apps also offer additional features like transaction fees, two-factor authentication (2FA), and backup options to help ensure the safety of your funds.

Types of Crypto Wallet Apps

There are two main types of crypto wallet apps: Hot Wallets and Cold Wallets.

Hot Wallet Apps

A hot wallet is a type of crypto wallet that is connected to the internet, enabling fast access and real-time transactions. Hot wallets are ideal for frequent traders who need quick access to their cryptocurrencies. They are often provided by exchanges or can be downloaded as mobile or desktop apps.

Popular Hot Wallet Apps:

- Exodus: A user-friendly wallet that supports multiple cryptocurrencies and integrates a built-in exchange feature.

- Trust Wallet: A mobile wallet that allows users to store Ethereum, Bitcoin, and several other tokens, with access to dApps.

- Electrum: Known for its fast transactions and low fees, primarily designed for Bitcoin users.

Pros of Hot Wallets:

- Instant access to funds.

- Easy to use and set up.

- Ideal for everyday transactions.

Cons of Hot Wallets:

- Vulnerable to online threats and hacks.

- Less secure compared to cold wallets.

Cold Wallet Apps

A cold wallet is a type of crypto wallet that is not connected to the internet. These wallets are often hardware devices that store private keys offline, making them more secure than hot wallets. Cold wallets are ideal for long-term storage of large amounts of cryptocurrency.

Popular Cold Wallet Apps:

- Ledger Nano X: A popular hardware wallet that supports multiple cryptocurrencies and uses a secure element chip for enhanced security.

- Trezor Model T: Another widely used hardware wallet with a touchscreen and a user-friendly interface.

- KeepKey: A hardware wallet designed to be simple and affordable, supporting many popular cryptocurrencies.

Pros of Cold Wallets:

- Highly secure, as they are immune to online hacks.

- Ideal for storing large amounts of cryptocurrency over a long period.

Cons of Cold Wallets:

- Not suitable for frequent transactions.

- Requires physical device handling and maintenance.

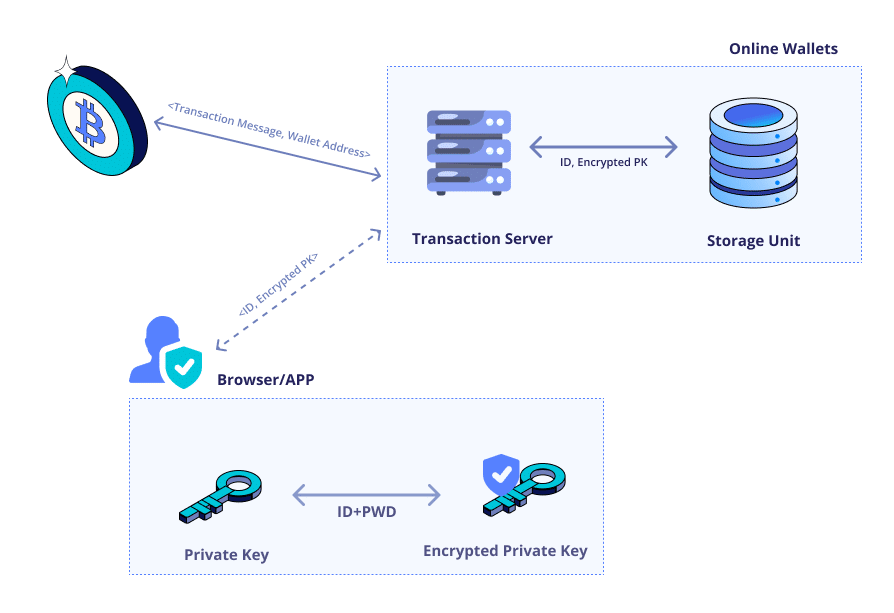

How Do Crypto Wallet Apps Work?

Crypto wallet apps function as both a storage solution and a transaction interface for cryptocurrencies. Here’s how they generally work:

Storing Private Keys

At the heart of any crypto wallet app is the private key. A private key is a cryptographic key that allows users to access and control their cryptocurrencies. It must be kept private, as anyone who has access to your private key can access your funds. Crypto wallet apps store these private keys securely.

Transaction Management

Crypto wallet apps allow users to send and receive digital assets. To make a transaction, the wallet app signs it with your private key, verifying ownership. The transaction is then broadcasted to the blockchain network for validation.

Backup and Recovery

Most crypto wallet apps offer a recovery phrase or seed phrase – a series of words that can be used to restore the wallet in case the device is lost or damaged. It is critical to store this recovery phrase securely, as it provides access to your private keys.

Interacting with dApps

Some advanced wallet apps allow users to interact with decentralized applications (dApps) directly. These applications operate on blockchain networks like Ethereum and facilitate activities such as lending, borrowing, gaming, and decentralized finance (DeFi).

Key Features to Look for in a Crypto Wallet App

When choosing a crypto wallet app, there are several important features to consider to ensure that your wallet meets your needs.

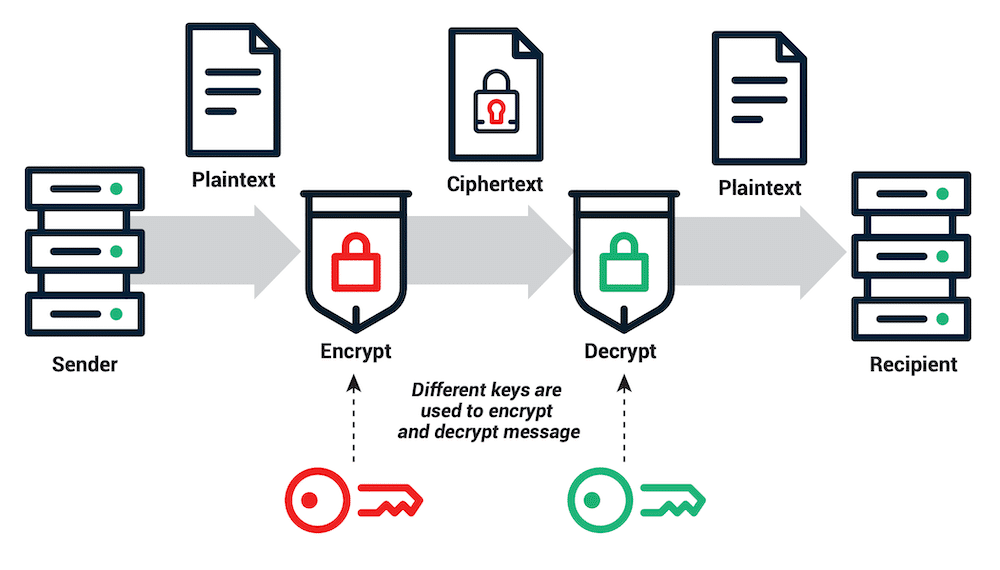

1. Security

Security is a top priority for any crypto wallet. Look for apps that offer:

- Two-Factor Authentication (2FA): Adds an extra layer of protection by requiring a second verification method (usually a code sent to your phone).

- Backup and Recovery Options: Always ensure your wallet app allows you to back up your wallet and provides an easy way to restore it if necessary.

- Encryption: The app should encrypt your private keys to protect them from unauthorized access.

2. Supported Cryptocurrencies

Different wallets support different cryptocurrencies. Some wallets support only popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), while others offer support for a broader range of coins and tokens. If you hold or plan to invest in multiple types of cryptocurrency, choose a wallet that supports a wide variety.

3. Ease of Use

Look for a wallet app that has an intuitive and easy-to-use interface, especially if you’re a beginner. A simple design and easy navigation can make the process of sending and receiving funds much smoother.

4. Transaction Fees

Crypto wallets charge transaction fees when you send or receive funds. These fees can vary depending on the wallet app and the blockchain network you are using. Some wallets allow users to choose the transaction fee (higher fees generally result in faster processing times).

5. Cross-Platform Availability

Consider whether the wallet app is available across different platforms such as mobile devices (iOS and Android) and desktops (Windows, Mac, Linux). Some wallets also allow for synchronization between different devices.

How to Choose the Right Crypto Wallet App for Your Needs

Choosing the right wallet depends on several factors, including trading habits, security needs, and technical expertise. One important aspect to consider is the security features of the wallet. A secure wallet will have strong encryption, two-factor authentication (2FA), and the ability to back up your private keys. It’s important to assess whether the app can handle your specific needs in terms of transaction types (e.g., daily trading or long-term storage).

Another key consideration is asset support. Different wallets support different cryptocurrencies, and some wallets cater specifically to certain types of digital assets (such as Bitcoin or Ethereum). If you plan to hold a range of digital currencies, you should opt for a multi-asset wallet. User experience is also crucial—especially for those who are new to crypto. Choose a wallet with an intuitive interface that aligns with your tech comfort level.

Additionally, assess whether the wallet is available on multiple platforms (iOS, Android, Web, etc.). This gives you flexibility in accessing your crypto assets from different devices. Lastly, the wallet’s reputation plays a role in selecting the right wallet. Make sure to read user reviews and check ratings on app stores or trusted crypto forums to gauge its reliability.

Private Keys, Public Keys, and Recovery Phrases: How Crypto Wallets Work

Understanding the difference between private and public keys is essential for any crypto user. Private keys are the critical piece of information that allows you to access and control your cryptocurrencies. They are typically long strings of numbers and letters and must be kept secure. If anyone gains access to your private key, they can steal your funds. Public keys, on the other hand, are used to receive cryptocurrency from others. You can share your public key without fear, as it does not grant access to your funds.

Crypto wallets use private keys to sign transactions and prove ownership. When you send crypto, your wallet signs the transaction with your private key to confirm that you are authorized to make the transaction. A crucial component of crypto wallet security is the recovery phrase, also known as a seed phrase. This phrase is a backup of your private key, typically consisting of 12 or 24 words. If you lose access to your wallet, you can use the recovery phrase to restore your funds.

It’s extremely important to keep your recovery phrase secure. If someone gains access to it, they can restore your wallet on their own device. Always store it offline, such as on paper or in a secure offline location. Without the recovery phrase, losing access to a crypto wallet could result in a permanent loss of funds.

The Importance of Backup and Recovery Options in Crypto Wallet Apps

The importance of backup and recovery options in a crypto wallet app cannot be overstated. Losing access to your wallet can result in the loss of all your funds, so it’s crucial to have a reliable way to back up your data and recover your wallet if something goes wrong. Most crypto wallet apps offer a seed phrase when you first set up the wallet. This is a series of 12 or 24 words that act as a backup to your private key. The seed phrase is the key to recovering your funds, even if you lose access to the device or app.

It’s important to back up your wallet in a secure location. Never store your seed phrase digitally on the same device as your wallet, as it could be compromised in case of a hack or malware attack. Consider writing it down on paper and keeping it in a safe place, such as a locked drawer or safe.

Additionally, some wallet apps offer cloud backup options, which can automatically back up your private keys and recovery phrases to cloud storage services like Google Drive or iCloud. While this option provides convenience, it’s critical to ensure your cloud storage account is secured with strong passwords and two-factor authentication.

In the event you need to restore your wallet, most apps provide a restore function where you enter your recovery phrase. This process is typically quick and can be done on any compatible wallet application or device.

The Evolution of Crypto Wallet Apps: From Simple Storage to Integrated Finance Solutions

Crypto wallets have evolved significantly over the years, and the shift from simple storage solutions to integrated finance platforms has been one of the most notable changes. Initially, crypto wallets were designed simply to store and send digital currencies, such as Bitcoin or Ethereum. These early wallets were primarily focused on simple storage with limited additional features.

However, as the cryptocurrency ecosystem grew, wallet apps began integrating more advanced features, such as the ability to buy and sell cryptocurrencies directly within the wallet. Wallets like Exodus and Trust Wallet enabled users to trade between different digital assets without leaving the app. These advancements allowed for easier management of cryptocurrencies.

In recent years, decentralized finance (DeFi) has become a major part of the cryptocurrency landscape. Many crypto wallet apps now allow users to interact with DeFi applications directly through the wallet, including lending, borrowing, staking, and yield farming. This integration into the DeFi ecosystem has turned crypto wallets into fully-fledged financial tools, providing users with decentralized banking services, peer-to-peer lending, and investment opportunities.

Cross-chain support is another important development. Many wallet apps now support multiple blockchains, allowing users to store and manage a wide variety of cryptocurrencies beyond just Bitcoin and Ethereum. This multi-chain support enables wallets to interact with different decentralized applications (dApps) and decentralized exchanges (DEXs), further increasing the versatility of crypto wallets.

Key Considerations When Using Crypto Wallet Apps for Businesses

Businesses that deal with cryptocurrencies require specialized features to ensure their assets are secure and easily accessible. One of the most important considerations for businesses is security. Businesses often deal with larger sums of cryptocurrency, making them attractive targets for hackers. To ensure the highest level of security, businesses should opt for wallets that offer features like multisignature support, where multiple private keys are required to authorize transactions.

In addition to security, businesses need to account for accounting and taxation. Many crypto wallet apps now include features to track transactions for accounting purposes, helping businesses comply with tax regulations. Some wallets integrate with accounting software like QuickBooks or Xero to streamline the process of tracking crypto earnings and expenditures.

Payment processing is another area that businesses need to consider. Accepting cryptocurrency payments directly into a wallet app is common, but businesses should also evaluate how easy it is to convert these cryptocurrencies into fiat currencies. Some wallet apps integrate with crypto payment processors, making it easier to accept, convert, and manage cryptocurrency transactions.

For businesses with multiple employees handling cryptocurrency, wallet management features are essential. Many crypto wallet apps allow for multi-user or shared wallet setups, where access to funds can be restricted based on permissions. This ensures that employees can handle daily transactions without having full control over the business’s funds.

Advanced Crypto Wallet Features: Multisignature and Hardware Integration

As the crypto space matures, wallet apps are introducing more advanced security features. One such feature is multisignature (multisig) support, where a transaction requires approval from multiple parties before it is executed. For example, a wallet may require two out of three designated private keys to sign a transaction. This ensures that even if one key is compromised, the funds remain secure.

Another critical feature is hardware wallet integration. Hardware wallets like Ledger and Trezor store private keys offline, making them much more secure than hot wallets, which are connected to the internet. Many wallet apps now integrate with hardware wallets, allowing users to manage their assets both from a mobile app and from a dedicated hardware device. This combination offers a higher level of security and convenience.

Transaction limits are also important for advanced wallet users. Many wallet apps now allow users to set transaction limits, ensuring that large transactions require additional authentication or approvals. This feature is particularly useful for businesses or individuals who want to maintain strict control over their funds and avoid accidental or unauthorized transfers.

Crypto Wallet App Fees and Cost Structures

Fees associated with using crypto wallet apps vary depending on the type of transaction and the underlying blockchain network. Transaction fees are typically associated with sending cryptocurrencies. These fees vary based on factors like network congestion, transaction size, and the type of cryptocurrency being transferred. For example, sending Bitcoin may incur higher fees compared to sending a stablecoin like USDT.

In addition to transaction fees, some crypto wallet apps charge withdrawal fees, particularly when transferring assets to another wallet or exchange. These fees are often influenced by the blockchain network’s costs. Some wallet apps, however, offer fee-free transfers if you’re sending assets within the same platform.

Some wallet apps also offer premium versions that include extra features, such as advanced security options or enhanced customer support. These apps may charge a monthly or yearly fee, but they typically offer additional functionality that could be worth the investment.

It’s important to evaluate the overall cost structure of a wallet app, considering both transaction-related fees and any potential subscription costs, to ensure that it aligns with your usage and budget.

Read More : What Are Crypto Exchanges and How Do They Work?

Conclusion

Crypto wallet apps are an essential tool for anyone involved in the cryptocurrency space. They provide a secure and user-friendly way to store and manage digital assets, enabling quick and easy transactions. Whether you’re a beginner or an experienced investor, choosing the right wallet app can help you safeguard your crypto holdings and participate in the growing digital economy.

Remember to consider factors like security, ease of use, supported cryptocurrencies, and transaction fees when selecting a crypto wallet app. By choosing a trusted wallet and practicing good security habits, you can confidently navigate the world of cryptocurrencies.

FAQs

1. What is a Crypto Wallet App?

A crypto wallet app is a software application that allows you to store and manage your cryptocurrencies. It holds your private keys, enabling you to send, receive, and store digital assets securely.

2. How Secure are Crypto Wallet Apps?

Crypto wallet apps offer various security features like two-factor authentication (2FA), encryption, and backup options. While they are generally secure, the safety of your funds also depends on your personal practices, such as how well you protect your private key and recovery phrase.

3. Can I Use a Crypto Wallet App for Multiple Cryptocurrencies?

Yes, many crypto wallet apps support multiple cryptocurrencies. Some wallet apps allow you to store Bitcoin, Ethereum, and other altcoins, while others focus on specific coins.

4. What Happens if I Lose My Phone or App?

If you lose access to your wallet app, you can restore it using your seed phrase or recovery phrase. This phrase is generated when you first set up your wallet, and it can be used to restore your wallet on any compatible device.

5. Are Crypto Wallet Apps Free to Use?

Most crypto wallet apps are free to download and use, but they may charge transaction fees when sending or receiving cryptocurrencies. The transaction fees are usually dependent on the blockchain network used.

6. What Is the Difference Between Hot and Cold Wallet Apps?

Hot wallet apps are connected to the internet and provide quick access to your funds, while cold wallet apps (typically hardware wallets) store your private keys offline for extra security.

7. Can I Use a Crypto Wallet App for DeFi?

Yes, some crypto wallet apps are designed to interact with decentralized finance (DeFi) applications, allowing you to participate in activities like lending, borrowing, and yield farming directly from the wallet.